The standard promise from any politician seeking election to an office. “I will lower your taxes.”

I say it and I mean it. Erlanger has not had a balanced budget in quite some time and I want to take an opportunity to explain Erlanger’s financial picture at a high level. The city has been taking in more money than it spends for several years and I’d get into the nuts and bolts of taxes in your city.

Revenues

Revenues are the money that the city takes in. The city brought in revenues from the following sources in 2016/2017 Actual General Fund:

- Property taxes: $4,507,522 – approx. 26% of total revenues

- License and Permits: $9,115,696 – approx. 53% of total revenues

- Intergovernmental: $835,711 – approx. 5% of total revenues

- Uses of Property: $32,314 – approx. less than 1% of total revenues

- Charges for Service: $2,142,858 – approx. 13% of total revenues

- Fines and Forfeits: $59,942 – approx. less than 1% of total revenues

- Interest: $127,880 – approx. less than 1% of total revenues

- Miscellaneous: $314,799– approx. 2% of total revenues

Total Revenues: $17,136,722

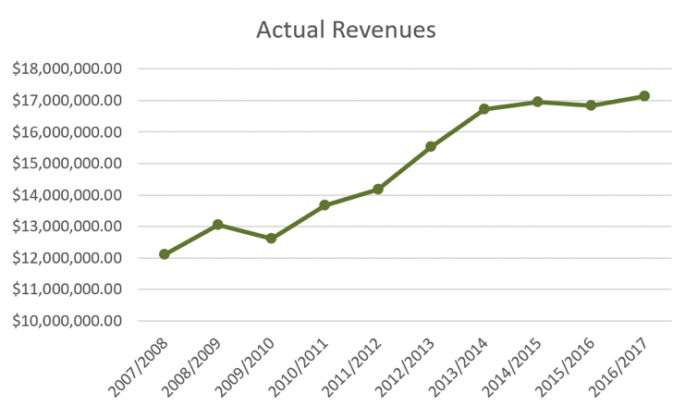

History:

These numbers are based on 2016/2017 Actual General Fund from the Erlanger City Budget

Appropriations

Appropriations (or expenses) that are paid from the city budget include the different departments including Fire/EMS, Police, Public Works, Communications/Technology, General government and any debt the city is paying off (bonds, etc).

- General Government: $1,889,589

- Communications, Technology, and Innovations Dept.:$679,372

- Police: $5,634,736

- Fire/EMS: $3,722,664

- Public Works: $1,919,171

- Debt Service: $896,319

Total Appropriations: $14,741,851

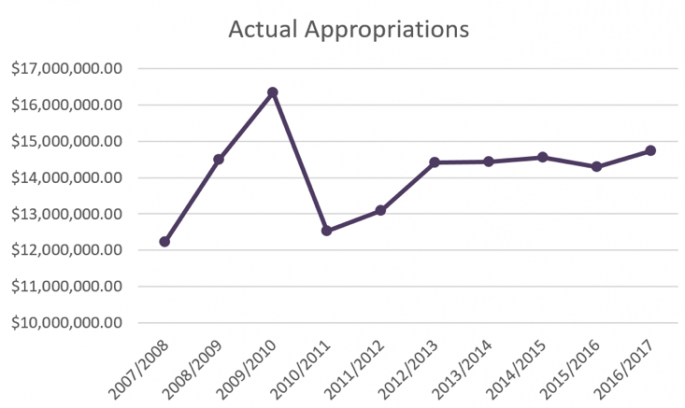

History:

Surplus

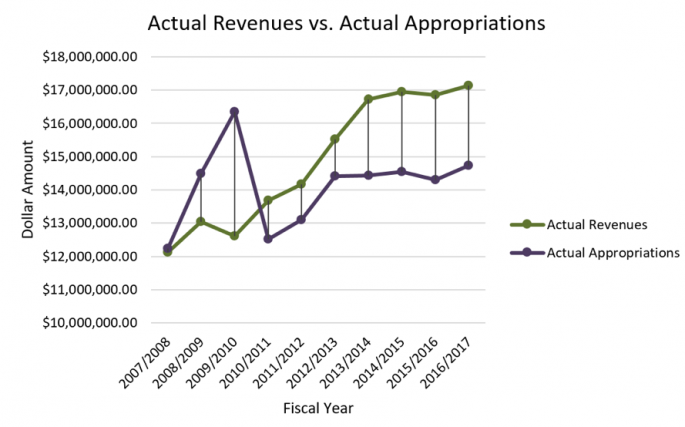

A surplus is the when the amount of revenues or income coming into the city exceeds the amount of appropriates or expenses. Over the past 7 years, the City of Erlanger has seen a surplus between 1 and 2.5 million dollars every year. With the examples from the FY 2016/2017 Budget, you can see the following:

- $17,136,722 in Revenues – $14,741,851 in Expenses = $2,394,871 Surplus

With an annual surplus that large, it is imperative to make changes that will bring you closer to a balanced budget. There are two ways to do this:

- Spend more money

- Reduce revenues (taxes).

Cutting Taxes and Increasing Spending

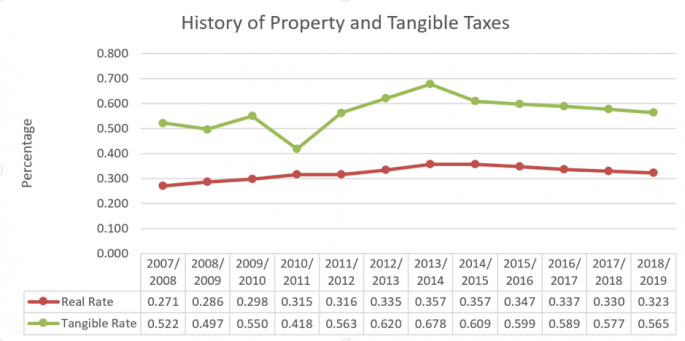

For the last four years, the city has been doing a combination of both. On Tuesday, council is set to vote on the city’s 4th consecutive property/tangible tax decrease. Even with the tax decreases, we have seen record high revenues and amazing economic development. The city also has been able to increase funding for the repair and replacement of roads and sidewalks.

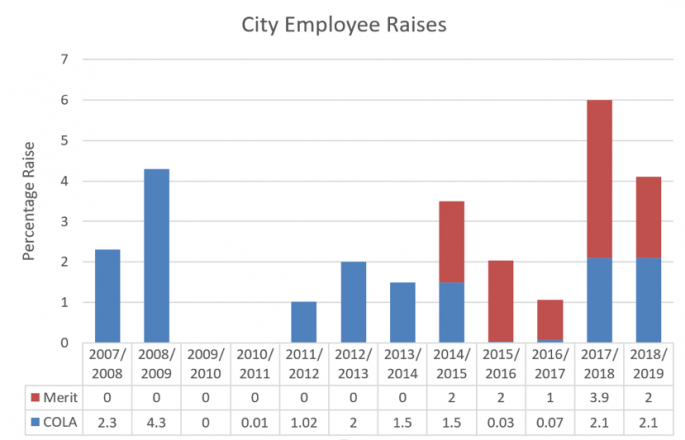

We have also given raises to our city employees. For many years, we heard the Police and Fire Departments say that the city did not keep up with regional salaries. They reported issues with turnover in each department because salaries were not competitive with neighboring cities. By researching and comparing salaries for neighboring cities, I was able to work with council to begin righting the ship last fiscal year with an increase of 6% to their salaries for FY 2017/2018.

I also worked with city staff to add paid maternity/paternity leave as an additional benefit for employees that began July 2017. These additional appropriations coupled with the tax cuts for last year still amounted to a surplus for the city.

Our budget includes 30% of our appropriations in a reserve account. This 30% equates to approximately $4.4 million which is the recommended amount to have on hand in the event of an emergency.

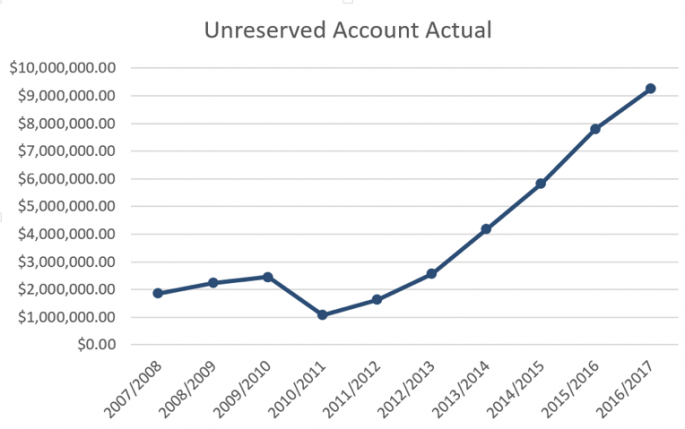

In addition to the reserve account, the city has a second account called the unreserved account. The unreserved account is made up of surplus dollar amounts and at this point is almost over $10 million.

The Future

With the increased economic development and increased property values, we can continue to work on a combination of additional careful spending and the reduction of taxes. It is time to start tackling the insurance premium tax. Currently we sit at 10%, which we need to start making small decreases in the next budget cycle. Citizens and businesses alike would see potential decreases to health, car, life, and home/rental insurances by lowering this tax.

The taxes the city collects belongs to and is used for the citizens and businesses that it is collected from. If we have year over year of surpluses adding up to tens of millions of dollars, we aren’t being good stewards of this money and should be working towards taking less and spending it on improving the infrastructure and image of our city.

I’m glad you made it through this dive into the dollars and cents with me. Don’t you think Erlanger may be better off with an economist that’s good with (and may enjoy) crunching the numbers?

Revenues, appropriations, and unreserved account numbers are based on fiscal year 2016/2017 Actual numbers. The 2017/2018 Actual numbers are not available until the end of September 2018 after an audit process is complete.

Paul Schaber

Jessica,

Thank you so much for sharing this financial information. Ever since Toyota announced they were leaving the city of Erlanger, I was under the impression that the city was operating on a tight budget. Obviously this is not the case!

All of this leads me to this question. Will the development of the old Showcase Cinema site offset the revenue from the loss of Toyota or will it add an additional projected surplus to the city?

Thank you for the work that you have been doing and you have my support in November.

Regards,

Paul Schaber

Jessica Fette

Thank you for you support Paul! Mayor Hermes and I stopped by your house yesterday. We were in the neighborhood.

Had the city done nothing, the loss of Toyota would have reduced the revenue by about $1,500,000 per year. But we have aggressively sought other businesses to fill the “hole” they would have left. At one time Toyota had 1,600 people working in Erlanger. By the time they announced they were leaving, there was only about 800. Their departure was thankfully spread out over 3 years, and they were officially gone in December 2017.

During the time that Toyota was exiting Erlanger:

Thankfully the city has never been operating at a loss. When the cinema site is up and running (and when the old Toyota building is full) the revenue will be over and above that what’s collected now. Now, with that comes extra expenses, additional road expansions and replacements to tolerate the additional traffic load. Additional demands on city services (911 calls, building permits and inspections, road maintenance, right of way maintenance, etc). Additional staff may be required.

Overall the city is in very good shape, and should continue to be for a long time.

Tom Kolkmeier

Jessica,

Thanks for the great explanation! I have a couple additional questions about the budgetary numbers. Does Erlanger do budget projections as part of their planning process? (We have several new development sites in work with potential for additional revenues. Assuming we didn’t give it all up to get the companies to locate here…) Can you present graphs that show individual revenue categories over the same years? I’d like to see where we’re increasing revenues and where we are flat or declining. (I see revenue relatively flat the last few years despite some major wins by the Mayor and council.)